“Blessed is the nation that doesn’t need heroes" Goethe. “Hero-worship is strongest where there is least regard for human freedom.” Herbert Spencer

Search This Blog

Showing posts with label economic growth. Show all posts

Showing posts with label economic growth. Show all posts

Sunday 23 May 2021

Friday 31 July 2020

Economics for Non Economists 3 – Explaining GDP and Economic Growth

By Girish

Menon

Introduction

You will have

recently read:

What does this mean?

Just like the

Forbes magazine compiles an annual list of the richest individuals on planet

earth, most countries participate in an annual ‘show of wealth’. The most

commonly used measure in this competition is called GDP. At the end of 2019 the

top six countries were:

Table 1

Country

|

GDP

($ trillions)

|

Economic growth over previous year (%)

|

Per Capita GDP ($)

|

Share of World GDP (%)

|

19.5

|

2.2

|

59, 939

|

24

|

|

12.2

|

6.9

|

8,612

|

15

|

|

4.9

|

1.7

|

38,214

|

6

|

|

3.7

|

2.2

|

44,680

|

4.5

|

|

2.7

|

6.7

|

1,980

|

3.28

|

|

2.6

|

1.8

|

39.532

|

3,26

|

What do these terms mean?

Simply

defined, GDP or Gross Domestic

Product is the money value of all goods and services (goods) produced within an

economy in a period of time. In Table 1 the GDP is estimated over the year of

2019. The data quoted in the introduction compares GDP changes over the first two quarters of 2020.

Economic growth is a measure of the

additional goods produced by an economy over the last period of time (say a year or a quarter).

Per Capita GDP means the value of goods

each resident would get if all goods produced in an economy is shared equally.

This is calculated by dividing the GDP with the residents of the country. Do you think per capita GDP is an accurate description of how goods are actually distributed in an economy?

Share of World GDP means the share of

global goods produced by an economy. This is calculated by dividing each

country’s GDP with the whole world’s total GDP.

Why is GDP and the rate of Economic growth

so important?

Materialism is the underlying

principle of using GDP and economic growth as the most important indicator

of economic performance. Materialism, according to the Cambridge English

Dictionary, is the belief that having money and possessions is the most

important thing in life. It follows that as one’s material goods increases

one’s standard of living (happiness) tends to increase.

GDP is a tool that

measures the volume of material goods produced by an economy. A high rate of

economic growth demonstrates the rate at which the material goods in an economy

is increasing and as a result the happiness of the residents as well. So, when

the rate of economic growth becomes negative, as in the data mentioned in the

introduction, it follows that your happiness will decrease.

Are GDP

and GNP the same?

They are similar but

not the same. GDP measures the volume of goods produced by people living within

the boundaries of an economy. The output of Nissan’s Sunderland plant will be

included in UK UK will be added to calculate UK

GNP stands for Gross

National Product. It is a measure of the volume of goods produced by British

nationals living in the UK

Is GDP an accurate measure of the volume of

goods produced within an economy?

The answer is

No. The calculation is arduous and with questionable assumptions which I will

not go into here. I will however mention some weaknesses here:

1. Even though there are some standardised procedures for

its computation governments are known to deliberately intervene in its

methodology and computation.

2. Not all goods are included. For example if you clean

your own house and look after your family – these services are not included.

However, if you employ a cleaner, a cook, a nanny and a driver then their

services are included.

3. In some countries where there is a large informal economy. The goods produced by such activities are not be included in GDP computations.

Does an increase in GDP necessarily improve

residents’ happiness?

In economics, happiness

is better known as welfare.

If there is an

earthquake in your country and many roads, buildings, bridges, stadia are

destroyed. Then rebuilding them will increase the national GDP but has it

improved the citizens’ welfare?

As a resultant

of economic growth the quality of air you breathe has gone down and the water

supply is polluted. Has this improved your standard of living?

Due to

increased standard of living everybody has a car and you are now required to spend one hour extra

in commuting time. Has this resulted in improved happiness?

What is the prognosis for GDP and economic

growth?

It appears

that due to Covid-19 the GDP of most nations will be lower than in 2019. These

economies will have negative economic growth which means that in 2020 they will

produce fewer goods than in 2019.

When the GDP

falls, the terms most used are recession and depression. The difference between

the two according to Harry Truman is ‘It's a recession when your neighbour loses his job; it's a depression when you lose yours’ .

As

you have seen in the news, firms are busy firing staff which means there will

be increased unemployment. Since more people are unemployed they will not have

money to buy goods in the future and so there will be even less demand for goods in

the future and those who have jobs today may lose their jobs next year in a downward spiral of negative economic growth begetting even more negative growth.

Will there be lower

emphasis on GDP and economic growth in the future? For such a change to happen

there needs a material change in organising the world economy. (If you wish to read further click here)

I hope it happens

in my lifetime.

* - annualised rate---Also watch

How the Economic Machine Works by Ray Dallio

Wednesday 27 May 2020

Tuesday 27 August 2019

Will Modi's Muslims pay the price for Kashmir?

By Girish Menon

Modi’s Muslims, i.e. most middle class Indians (this writer

included) supported Modi’s decision to de-operationalise Art. 370 in Kashmir . It is now three weeks since the decision and India

In response to India ’s action, Pakistan

The Indian government,

worried about the global interest, has responded with its own version of diplomacy

with a majority of UN Security Council Members not giving Pakistan India

Firstly, it is possible that

India may send troops to Afghanistan

Secondly, President Trump

wants India India will not insist that Indian consumer data

is stored in India

Thirdly, India maybe forced to purchase more expensive

defence equipment from the US. India's

Economic growth in the

Indian economy is already at the much derided Hindu rate of growth. Investment

by firms is down, while firms are shutting down and unemployment is rising. If India removes further trade barriers to the

already suffering French and US

===

Wednesday 9 January 2019

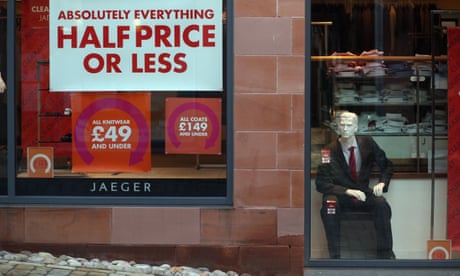

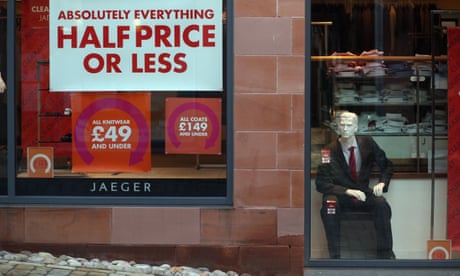

Brexit proved our economy is broken, but our leaders still have no clue how to fix it

Politicians obsess over GDP growth yet its benefits are unequally shared. And Labour leave areas suffer most writes Aditya Chakrabortty in The Guardian

From David Cameron down, leading remainers considered the economy their trump card. In the biggest single choice Britain had had to make for four decades, they were sure economics would be the deciding factor. But with less than a month to go before the vote, seasoned operative Coetzee could see the strategy was failing. Why, just a few days earlier, George Osborne had produced Treasury analysis that Brexit would send house prices plunging by as much as 18% – and BBC journalists reported being deluged with calls from would-be buyers asking where they could sign up.

As remain started losing its central argument so, internal polling analysis showed, it began trailing leave. Hence the panic in that late-night memo, quoted by Tim Shipman in his history of the referendum, All Out War. One of Shipman’s Labour sources in the campaign cut close to the bone: “When we started just saying, ‘the economy will be fucked’, it showed what a profound misunderstanding they had of Labour motives. Across the north-east and the north-west people already felt like the economy was fucked and not working for them.”

Bingo. Project Fear stuck as a catchphrase precisely because Osborne’s rhapsodies over the health of the economy sounded to so many like Project Fantasy.

Osborne banged on about Britain’s miracle recovery even while pay remained below pre-crash levels. His replacement at No 11, Philip Hammond, made a big flourish in his last budget of doling out “little extras” to schools where teachers now face huge funding shortfalls. Over the past few years Westminster has embarked on a march of the makers that looked more like a punch-drunk stagger, erected a northern powerhouse almost invisible to the naked eye, and declared a war on skivers and freeloaders – led by Iain Duncan Smith, the cabinet minister who claimed £39 in expenses for one solitary breakfast.

But this economic chasm runs deeper and longer than just the past decade. Around the same time that Coetzee was raising the alarm in Westminster, I was reporting in Pontypool, south Wales. It was market day, and locals reminisced about old times, when the town centre would be “rammed”. In that day’s drizzle it was half-deserted. In the 80s and 90s, voters in south Wales were assured that vibrant new industries would replace the coalmines and steelworks that had shut down. What actually filled the void was public spending, and casual work and self-employment that barely paid its way.

“It’s dead now, because they took what they wanted,” Neil told me, his glasses specked with paint from his day job as a decorator. “They” meant Westminster, London, the rich. “Thatcher smashed the unions. Boosh! We’re out of here. Boosh! They’ve moved on.” Raised in a Labour family in a blood-red part of the country that had been deceived by the political classes for so long, he now considered all politicians “liars”. And in the EU referendum, he intended to let them know.

In the crudest of ways, Neil and others got some of what they wanted. Since the summer of 2016, politicians and pundits will freely declare that something in British politics and economics is broken. The trouble is, the governing classes are no closer to knowing what exactly is bust, let alone how to fix it.

It ultimately comes down to this: decades of privatisation, hammering unions and chucking billions at the housing market while stripping the welfare state has effectively ended any semblance of a national, redistributive economy in which a child born in Sunderland can expect to have similar life chances to one born in Surrey. Yet politicians remain fixated on mechanisms that no longer work adequately for those who actually depend on the economy. They obsess over GDP growth when the benefits of that are unequally shared between classes and regions. They boast about job creation when wages are still on the floor.

Most of all, they brag about London, the one undoubted gleaming success of the British economic model. “A pound spent in Croydon is of far more value to the country than a pound spent in Strathclyde,” to quote Boris Johnson, the Conservative party’s last surviving greyback. But that is to ignore how London itself is rapidly becoming unlivable for many Londoners. New research by academics the Foundational Economy Collective shows that Londoners are the least likely in the country to have a mortgage and the most likely to swim in the shark-infested waters of the private rental sector. This is great for landlords and for employers, who enjoy a conveyor belt of ready-made renters and workers supplied to them from the rest of Britain and Europe. It is not such a great bargain for the rest of us. The high income generated by London is matched by the massive income inequality suffered by Londoners.

The irony is that Neil and other Labour leave voters have handed the keys to the very people least interested in reversing any of this. The top economic brains among the Brexiteers, miserable throwbacks such as Patrick Minford and John Redwood, believe the problem with Thatcher’s revolution is that it didn’t go far enough.

We rarely ask people what they want from the economy; if we did it more often, the answers might surprise us. The free-marketeers at the Legatum Institute did pose the question in a survey conducted in 2017. Top priorities for respondents were: food and water; emergency services; universal healthcare; a good house; a decent well-paying job; and compulsory and free education. At the bottom were owning a car and cheap air travel. HS2, a new runway at Heathrow or a garden bridge on the Thames didn’t even rank.

After reporting the survey, the Legatum Institute concluded: “Significant portions of the country … are vehemently anti-capitalist.” The report was co-authored by Matthew Elliott, former head of the Vote Leave campaign. Which just about sums up the Brexiteers’ politics: savvy enough to listen to what people want, cynical enough never to enact it.

Illustration: Sébastien Thibault

Just after midnight on 25 May 2016, a senior staffer in the remain campaign sent colleagues an urgent message. “Voters are very sceptical about our warnings on the economy,” began his email. “They don’t trust the numbers. They don’t trust the Treasury.” As head of strategy for Britain Stronger in Europe, Ryan Coetzee had bombarded Britons with evidence of the economic damage they would do to themselves if they didn’t stay in the EU. He and his team enlisted the Bank of England, the IMF, the OECD and pretty much every acronym that mattered. They’d wagged fingers, flung numbers around and pointed out the danger signs.

Just after midnight on 25 May 2016, a senior staffer in the remain campaign sent colleagues an urgent message. “Voters are very sceptical about our warnings on the economy,” began his email. “They don’t trust the numbers. They don’t trust the Treasury.” As head of strategy for Britain Stronger in Europe, Ryan Coetzee had bombarded Britons with evidence of the economic damage they would do to themselves if they didn’t stay in the EU. He and his team enlisted the Bank of England, the IMF, the OECD and pretty much every acronym that mattered. They’d wagged fingers, flung numbers around and pointed out the danger signs.

From David Cameron down, leading remainers considered the economy their trump card. In the biggest single choice Britain had had to make for four decades, they were sure economics would be the deciding factor. But with less than a month to go before the vote, seasoned operative Coetzee could see the strategy was failing. Why, just a few days earlier, George Osborne had produced Treasury analysis that Brexit would send house prices plunging by as much as 18% – and BBC journalists reported being deluged with calls from would-be buyers asking where they could sign up.

As remain started losing its central argument so, internal polling analysis showed, it began trailing leave. Hence the panic in that late-night memo, quoted by Tim Shipman in his history of the referendum, All Out War. One of Shipman’s Labour sources in the campaign cut close to the bone: “When we started just saying, ‘the economy will be fucked’, it showed what a profound misunderstanding they had of Labour motives. Across the north-east and the north-west people already felt like the economy was fucked and not working for them.”

Bingo. Project Fear stuck as a catchphrase precisely because Osborne’s rhapsodies over the health of the economy sounded to so many like Project Fantasy.

Osborne banged on about Britain’s miracle recovery even while pay remained below pre-crash levels. His replacement at No 11, Philip Hammond, made a big flourish in his last budget of doling out “little extras” to schools where teachers now face huge funding shortfalls. Over the past few years Westminster has embarked on a march of the makers that looked more like a punch-drunk stagger, erected a northern powerhouse almost invisible to the naked eye, and declared a war on skivers and freeloaders – led by Iain Duncan Smith, the cabinet minister who claimed £39 in expenses for one solitary breakfast.

But this economic chasm runs deeper and longer than just the past decade. Around the same time that Coetzee was raising the alarm in Westminster, I was reporting in Pontypool, south Wales. It was market day, and locals reminisced about old times, when the town centre would be “rammed”. In that day’s drizzle it was half-deserted. In the 80s and 90s, voters in south Wales were assured that vibrant new industries would replace the coalmines and steelworks that had shut down. What actually filled the void was public spending, and casual work and self-employment that barely paid its way.

“It’s dead now, because they took what they wanted,” Neil told me, his glasses specked with paint from his day job as a decorator. “They” meant Westminster, London, the rich. “Thatcher smashed the unions. Boosh! We’re out of here. Boosh! They’ve moved on.” Raised in a Labour family in a blood-red part of the country that had been deceived by the political classes for so long, he now considered all politicians “liars”. And in the EU referendum, he intended to let them know.

In the crudest of ways, Neil and others got some of what they wanted. Since the summer of 2016, politicians and pundits will freely declare that something in British politics and economics is broken. The trouble is, the governing classes are no closer to knowing what exactly is bust, let alone how to fix it.

It ultimately comes down to this: decades of privatisation, hammering unions and chucking billions at the housing market while stripping the welfare state has effectively ended any semblance of a national, redistributive economy in which a child born in Sunderland can expect to have similar life chances to one born in Surrey. Yet politicians remain fixated on mechanisms that no longer work adequately for those who actually depend on the economy. They obsess over GDP growth when the benefits of that are unequally shared between classes and regions. They boast about job creation when wages are still on the floor.

Most of all, they brag about London, the one undoubted gleaming success of the British economic model. “A pound spent in Croydon is of far more value to the country than a pound spent in Strathclyde,” to quote Boris Johnson, the Conservative party’s last surviving greyback. But that is to ignore how London itself is rapidly becoming unlivable for many Londoners. New research by academics the Foundational Economy Collective shows that Londoners are the least likely in the country to have a mortgage and the most likely to swim in the shark-infested waters of the private rental sector. This is great for landlords and for employers, who enjoy a conveyor belt of ready-made renters and workers supplied to them from the rest of Britain and Europe. It is not such a great bargain for the rest of us. The high income generated by London is matched by the massive income inequality suffered by Londoners.

The irony is that Neil and other Labour leave voters have handed the keys to the very people least interested in reversing any of this. The top economic brains among the Brexiteers, miserable throwbacks such as Patrick Minford and John Redwood, believe the problem with Thatcher’s revolution is that it didn’t go far enough.

We rarely ask people what they want from the economy; if we did it more often, the answers might surprise us. The free-marketeers at the Legatum Institute did pose the question in a survey conducted in 2017. Top priorities for respondents were: food and water; emergency services; universal healthcare; a good house; a decent well-paying job; and compulsory and free education. At the bottom were owning a car and cheap air travel. HS2, a new runway at Heathrow or a garden bridge on the Thames didn’t even rank.

After reporting the survey, the Legatum Institute concluded: “Significant portions of the country … are vehemently anti-capitalist.” The report was co-authored by Matthew Elliott, former head of the Vote Leave campaign. Which just about sums up the Brexiteers’ politics: savvy enough to listen to what people want, cynical enough never to enact it.

Monday 25 April 2016

Stunted growth: the mystery of the UK’s productivity crisis

Duncan Weldon in The Guardian

Without it the future is bleak, but despite a bewildering array of theories for why this key economic driver has dropped there is no clear answer

Illustration: Robert G Fresson

Our economic future isn’t what it used to be. In March the Office for Budget Responsibility (OBR) revised down its growth estimates for each of the next five years. The chancellor was quick to blame a weakening world economy but the true driver lies closer to home. The problem isn’t a loud global economic crash but something much quieter: engine trouble. Productivity growth, the long-term motor of rising living standards, is slowing. The fact that this appears to be happening across the globe offers scant consolation.

What’s worse is that no one is entirely sure what is causing the problem or how to fix it. And it is coming at about the worst time imaginable: global demographics are changing, with the supply of new workers set to slow and the older share of the population rising. The future is of course inherently unknowable, but the reasons for longer-term pessimism on economic growth are starting to stack up.

Productivity – the amount of output produced for each hour worked – rose at a fairly steady annual rate of about 2.2% in the UK for decades before the recession. Since the crisis though, that annual growth rate has collapsed to under 0.5%. The OBR has decided to revise down its future assumption on productivity from that pre-crisis 2.2% to a lower 2%. That small revision was enough to give the chancellor a large fiscal headache in his latest budget, but it still assumes a big rebound in productivity growth from its current level. What if that rebound doesn’t come?

The near death of the British steel industry is a tragedy. But for all the political heat it has generated, its long-term consequences wouldn’t be as serious as the wider crisis. For while closing mills are highly visible, slipping productivity is not.

Looking at the global picture shows that while there are of course national nuances, the overall impression is grim and dates back to before the 2008 crash. Everywhere from the “dynamic” United States to “sclerotic” France, productivity growth has dropped considerably in recent years. The UK is an outlier with a bigger fall than many, but not by much.

Some of this could be explained by measurement issues. To use every economist’s favourite example, it is straightforward to measure the inputs, the outputs – and hence the productivity – of a widget factory, even if no one is really sure what a widget is. It is harder to do the same with an online widget brand manager. But the mismeasurement would have to be on an unprecedented scale to explain away the problem.

Our economic future isn’t what it used to be. In March the Office for Budget Responsibility (OBR) revised down its growth estimates for each of the next five years. The chancellor was quick to blame a weakening world economy but the true driver lies closer to home. The problem isn’t a loud global economic crash but something much quieter: engine trouble. Productivity growth, the long-term motor of rising living standards, is slowing. The fact that this appears to be happening across the globe offers scant consolation.

What’s worse is that no one is entirely sure what is causing the problem or how to fix it. And it is coming at about the worst time imaginable: global demographics are changing, with the supply of new workers set to slow and the older share of the population rising. The future is of course inherently unknowable, but the reasons for longer-term pessimism on economic growth are starting to stack up.

Productivity – the amount of output produced for each hour worked – rose at a fairly steady annual rate of about 2.2% in the UK for decades before the recession. Since the crisis though, that annual growth rate has collapsed to under 0.5%. The OBR has decided to revise down its future assumption on productivity from that pre-crisis 2.2% to a lower 2%. That small revision was enough to give the chancellor a large fiscal headache in his latest budget, but it still assumes a big rebound in productivity growth from its current level. What if that rebound doesn’t come?

The near death of the British steel industry is a tragedy. But for all the political heat it has generated, its long-term consequences wouldn’t be as serious as the wider crisis. For while closing mills are highly visible, slipping productivity is not.

Looking at the global picture shows that while there are of course national nuances, the overall impression is grim and dates back to before the 2008 crash. Everywhere from the “dynamic” United States to “sclerotic” France, productivity growth has dropped considerably in recent years. The UK is an outlier with a bigger fall than many, but not by much.

Some of this could be explained by measurement issues. To use every economist’s favourite example, it is straightforward to measure the inputs, the outputs – and hence the productivity – of a widget factory, even if no one is really sure what a widget is. It is harder to do the same with an online widget brand manager. But the mismeasurement would have to be on an unprecedented scale to explain away the problem.

What we are left with is a bewildering array of theories as to what has driven the fall but no clear answer. We know the productivity slowdown is broad based and happening across most sectors of the economy. Lower corporate and public investment than in the past almost certainly explains some of the shortfall. Weaker labour bargaining power than in previous decades might also be playing a role. Low wages are allowing low-skill, low-productivity business models to expand and deincentivising corporate spending on new kit. Why spend on expensive labour-saving technology when labour itself is cheap?

But if you think you’ve found the full answer, you probably need to read more. There almost certainly isn’t a single explanation. It’s still perfectly possible to argue that productivity pessimism is overdone, that we are still suffering the lingering after-effects of the financial crisis that will eventually end. But with each passing year that becomes more difficult. A good strategy is to hope for the best but prepare for the worst. And the worst is pretty bad.

But if you think you’ve found the full answer, you probably need to read more. There almost certainly isn’t a single explanation. It’s still perfectly possible to argue that productivity pessimism is overdone, that we are still suffering the lingering after-effects of the financial crisis that will eventually end. But with each passing year that becomes more difficult. A good strategy is to hope for the best but prepare for the worst. And the worst is pretty bad.

George Osborne at the Airbus factory in Filton, Bristol. Photograph: Andrew Matthews/PA

Productivity growth is more than just a financial concept, it’s a balm that can soothe class conflicts and take some of the sting out of distributional politics. If a worker’s output rises by 2% without an increase in their hours, then giving that worker a 2% pay rise is relatively straightforward. If their productivity is flat then a 2% pay rise results in either a fall in profits or a rise in prices. A world of lower productivity is a world of more intense fighting over the more meagre divisions of economic growth.

Productivity is one of two key factors determining the trend growth rate of an economy; the speed limit at which a country can expand without pushing up prices. The other is population. Falling birth rates across the advanced economies created a demographic “sweet spot” that lasted from the late 70s until fairly recently. Fewer children meant a rising share of the population was of working age. But fewer children in the past means fewer workers today and rising longevity means a rising share of the population who are retired. Across the west, the amount of workers for each retired person is heading in the wrong direction. Increasing the retirement age and more immigration are both theoretical fixes, but the scale of both required to fundamentally change the picture is almost certainly politically impossible.

Slowing population growth and weaker expected productivity growth have led the US Congressional Budget Office to revise down its estimate of US trend growth from north of 3% in the 1990s and 2000s to closer to 2%. In the UK, policymakers once thought trend growth was 2.75% and have now cut that to 2.2%. Without a productivity bounce that could fall to closer to 1-1.5% in the coming years.

UK's productivity plan is ‘vague collection of existing policies’

Japan is the usual cautionary tale of what happens when growth slows. A country that had a financial bust, made policy mistakes in the aftermath and then experienced an ageing society. But at least productivity growth didn’t collapse. Headline economic growth was weak and the government’s debt burden has soared, but real incomes and employment held up well. Japanese demographic transition at the same time as a productivity crunch is the worrying possibility facing the west.

So what are policymakers to do? They could accept lower growth and concentrate on distribution. Of course the politics of redistribution are much easier when resources are growing. Lower growth also means that the public and private debt piles built up across the west in anticipation of a brighter future would be much harder to deal with. The obvious answer is to increase public investment. This alone wouldn’t solve the productivity crisis but it could help, and certainly wouldn’t hurt. At a time when government borrowing costs are near historical lows this is about as close to a free lunch as economic policy ever gets.

Finding ways to boost corporate investment is trickier, as there isn’t much in the way of direct policy levers open to government. Reforming corporate governance to encourage more long-term decision-making could help. And while economists tend to assume that productivity growth leads to wage growth, there could be circumstances in which the relationship is inverted. The government’s new national living wage may act as a spur to improve productivity as businesses see their cost-base rise.

But if productivity remains low then difficult choices lie ahead. We’ll need either a substantially smaller state with less generous social security, or higher tax revenues as a share of the economy. That means raising the kind of taxes that bring in substantial sums – VAT, national insurance and income tax.

Neither a smaller state nor higher taxes are likely to prove popular. But governing in a lower-growth world was never going to be easy.

Wednesday 25 November 2015

Consume more, conserve more: sorry, but we just can’t do both

Economic growth is tearing the planet apart, and new research suggests that it can’t be reconciled with sustainability

George Monbiot in The Guardian

We can have it all: that is the promise of our age. We can own every gadget we are capable of imagining – and quite a few that we are not. We can live like monarchs without compromising the Earth’s capacity to sustain us. The promise that makes all this possible is that as economies develop, they become more efficient in their use of resources. In other words, they decouple.

There are two kinds of decoupling: relative and absolute. Relative decoupling means using less stuff with every unit of economic growth; absolute decoupling means a total reduction in the use of resources, even though the economy continues to grow. Almost all economists believe that decoupling – relative or absolute – is an inexorable feature of economic growth.

On this notion rests the concept of sustainable development. It sits at the heart of the climate talks in Paris next month and of every other summit on environmental issues. But it appears to be unfounded.

A paper published earlier this year in Proceedings of the National Academy of Sciences proposes that even the relative decoupling we claim to have achieved is an artefact of false accounting. It points out that governments and economists have measured our impacts in a way that seems irrational.

Here’s how the false accounting works. It takes the raw materials we extract in our own countries, adds them to our imports of stuff from other countries, then subtracts our exports, to end up with something called “domestic material consumption”. But by measuring only the products shifted from one nation to another, rather than the raw materials needed to create those products, it greatly underestimates the total use of resources by the rich nations.

For instance, if ores are mined and processed at home, these raw materials, as well as the machinery and infrastructure used to make finished metal, are included in the domestic material consumption accounts. But if we buy a metal product from abroad, only the weight of the metal is counted. So as mining and manufacturing shift from countries such as the UK and the US to countries like China and India, the rich nations appear to be using fewer resources. A more rational measure, called the material footprint, includes all the raw materials an economy uses, wherever they happen to be extracted. When these are taken into account, the apparent improvements in efficiency disappear.

Europe’s largest coal-fired power plant, in Belchatow, Poland. ‘New analysis suggests that in the EU, the US, Japan and the other rich nations, there have been ‘no improvements in resource productivity at all’.’ Photograph: Kacper Pempel/Reuters

In the UK, for instance, the absolute decoupling that the domestic material consumption accounts appear to show is replaced with an entirely different chart. Not only is there no absolute decoupling; there is no relative decoupling either. In fact, until the financial crisis in 2007, the graph was heading in the opposite direction: even relative to the rise in our gross domestic product, our economy was becoming less efficient in its use of materials. Against all predictions, a recoupling was taking place.

While the OECD has claimed that the richest countries have halved the intensity with which they use resources, the new analysis suggests that in the EU, the US, Japan and the other rich nations, there have been “no improvements in resource productivity at all”. This is astonishing news. It appears to makes a nonsense of everything we have been told about the trajectory of our environmental impacts.

I sent the paper to one of Britain’s leading thinkers on this issue, Chris Goodall, who has argued that the UK appears to have reached “peak stuff”: in other words, there has been a total reduction in our use of resources, otherwise known as absolute decoupling. What did he think?

To his great credit, he responded that “broadly, of course, they are right”, even though the new analysis appears to undermine the case he has made. He did have some reservations, however, particularly about the way in which the impacts of construction are calculated. I also consulted the country’s leading academic expert on the subject, Professor John Barrett. He told me that he and his colleagues had conducted a similar analysis, in this case of the UK’s energy use and greenhouse gas emissions, “and we find a similar pattern”. One of his papers reveals that while the UK’s carbon dioxide emissions officially fell by 194m tonnes between 1990 and 2012, this apparent reduction is more than cancelled out by the CO2 we commission through buying stuff from abroad. This rose by 280m tonnes in the same period.

Dozens of other papers come to similar conclusions. For instance, a report published in the journal Global Environmental Change found that with every doubling of income, a country needs a third more land and ocean to support its economy because of the rise in its consumption of animal products. A recent paper in the journal Resources found that the global consumption of materials has risen by 94% over 30 years, and has accelerated since 2000. “For the past 10 years, not even a relative decoupling was achieved on the global level.”

We can persuade ourselves that we are living on thin air, floating through a weightless economy, as gullible futurologists predicted in the 1990s. But it’s an illusion, created by the irrational accounting of our environmental impacts. This illusion permits an apparent reconciliation of incompatible policies.

Governments urge us both to consume more and to conserve more. We mustextract more fossil fuel from the ground, but burn less of it. We should reduce, reuse and recycle the stuff that enters our homes, and at the same time increase, discard and replace it. How else can the consumer economy grow? We should eat less meat to protect the living planet, and eat more meat to boost the farming industry. These policies are irreconcilable. The new analyses suggest that economic growth is the problem, regardless of whether the word sustainable is bolted to the front of it.

It’s not just that we don’t address this contradiction; scarcely anyone dares even name it. It’s as if the issue is too big, too frightening to contemplate. We seem unable to face the fact that our utopia is also our dystopia; that production appears to be indistinguishable from destruction.

George Monbiot in The Guardian

We can have it all: that is the promise of our age. We can own every gadget we are capable of imagining – and quite a few that we are not. We can live like monarchs without compromising the Earth’s capacity to sustain us. The promise that makes all this possible is that as economies develop, they become more efficient in their use of resources. In other words, they decouple.

There are two kinds of decoupling: relative and absolute. Relative decoupling means using less stuff with every unit of economic growth; absolute decoupling means a total reduction in the use of resources, even though the economy continues to grow. Almost all economists believe that decoupling – relative or absolute – is an inexorable feature of economic growth.

On this notion rests the concept of sustainable development. It sits at the heart of the climate talks in Paris next month and of every other summit on environmental issues. But it appears to be unfounded.

A paper published earlier this year in Proceedings of the National Academy of Sciences proposes that even the relative decoupling we claim to have achieved is an artefact of false accounting. It points out that governments and economists have measured our impacts in a way that seems irrational.

Here’s how the false accounting works. It takes the raw materials we extract in our own countries, adds them to our imports of stuff from other countries, then subtracts our exports, to end up with something called “domestic material consumption”. But by measuring only the products shifted from one nation to another, rather than the raw materials needed to create those products, it greatly underestimates the total use of resources by the rich nations.

For instance, if ores are mined and processed at home, these raw materials, as well as the machinery and infrastructure used to make finished metal, are included in the domestic material consumption accounts. But if we buy a metal product from abroad, only the weight of the metal is counted. So as mining and manufacturing shift from countries such as the UK and the US to countries like China and India, the rich nations appear to be using fewer resources. A more rational measure, called the material footprint, includes all the raw materials an economy uses, wherever they happen to be extracted. When these are taken into account, the apparent improvements in efficiency disappear.

Europe’s largest coal-fired power plant, in Belchatow, Poland. ‘New analysis suggests that in the EU, the US, Japan and the other rich nations, there have been ‘no improvements in resource productivity at all’.’ Photograph: Kacper Pempel/Reuters

In the UK, for instance, the absolute decoupling that the domestic material consumption accounts appear to show is replaced with an entirely different chart. Not only is there no absolute decoupling; there is no relative decoupling either. In fact, until the financial crisis in 2007, the graph was heading in the opposite direction: even relative to the rise in our gross domestic product, our economy was becoming less efficient in its use of materials. Against all predictions, a recoupling was taking place.

While the OECD has claimed that the richest countries have halved the intensity with which they use resources, the new analysis suggests that in the EU, the US, Japan and the other rich nations, there have been “no improvements in resource productivity at all”. This is astonishing news. It appears to makes a nonsense of everything we have been told about the trajectory of our environmental impacts.

I sent the paper to one of Britain’s leading thinkers on this issue, Chris Goodall, who has argued that the UK appears to have reached “peak stuff”: in other words, there has been a total reduction in our use of resources, otherwise known as absolute decoupling. What did he think?

To his great credit, he responded that “broadly, of course, they are right”, even though the new analysis appears to undermine the case he has made. He did have some reservations, however, particularly about the way in which the impacts of construction are calculated. I also consulted the country’s leading academic expert on the subject, Professor John Barrett. He told me that he and his colleagues had conducted a similar analysis, in this case of the UK’s energy use and greenhouse gas emissions, “and we find a similar pattern”. One of his papers reveals that while the UK’s carbon dioxide emissions officially fell by 194m tonnes between 1990 and 2012, this apparent reduction is more than cancelled out by the CO2 we commission through buying stuff from abroad. This rose by 280m tonnes in the same period.

Dozens of other papers come to similar conclusions. For instance, a report published in the journal Global Environmental Change found that with every doubling of income, a country needs a third more land and ocean to support its economy because of the rise in its consumption of animal products. A recent paper in the journal Resources found that the global consumption of materials has risen by 94% over 30 years, and has accelerated since 2000. “For the past 10 years, not even a relative decoupling was achieved on the global level.”

We can persuade ourselves that we are living on thin air, floating through a weightless economy, as gullible futurologists predicted in the 1990s. But it’s an illusion, created by the irrational accounting of our environmental impacts. This illusion permits an apparent reconciliation of incompatible policies.

Governments urge us both to consume more and to conserve more. We mustextract more fossil fuel from the ground, but burn less of it. We should reduce, reuse and recycle the stuff that enters our homes, and at the same time increase, discard and replace it. How else can the consumer economy grow? We should eat less meat to protect the living planet, and eat more meat to boost the farming industry. These policies are irreconcilable. The new analyses suggest that economic growth is the problem, regardless of whether the word sustainable is bolted to the front of it.

It’s not just that we don’t address this contradiction; scarcely anyone dares even name it. It’s as if the issue is too big, too frightening to contemplate. We seem unable to face the fact that our utopia is also our dystopia; that production appears to be indistinguishable from destruction.

Wednesday 26 August 2015

China's economic woes extend far beyond its stock market

Michael Boskin in The Guardian

The Chinese government’s heavy handed efforts to contain recent stock market volatility – the latest move prohibits short-selling and sales by major shareholders– have seriously damaged its credibility. But China’s policy failures should come as no surprise. Policymakers there are far from the first to mismanage financial markets, currencies, and trade. Many European governments, for example, suffered humiliating losses defending currencies that were misaligned in the early 1990s.

Still, China’s economy remains a source of significant uncertainty. Indeed, although the performance of China’s stock market and that of its real economy has not been closely correlated, a major slowdown is under way. That is a serious concern, occupying finance ministries, central banks, trading desks, and importers and exporters worldwide.

China’s government believed it could engineer a soft landing in the transition from torrid double-digit economic growth, fuelled by exports and investments, to steady and balanced growth underpinned by domestic consumption, especially of services. And, in fact, it enacted some sensible policies and reforms.

But rapid growth obscured many problems. For example, officials, seeking to secure promotions by achieving short-term economic targets, misallocated resources; basic industries such as steel and cement built up vast excess capacity; and bad loans accumulated on the balance sheets of banks and local governments.

Nowhere are the problems with this approach more apparent than in the attempt to plan urbanisation, which entailed the construction of large new cities – complete with modern infrastructure and plentiful housing – that have yet to be occupied.

In a sense, these ghost cities resemble the Russian empire’s Potemkin villages, built to create an impressive illusion for the passing Czarina; but China’s ghost cities are real and were presumably meant to do more than flatter the country’s leaders.

Now that economic growth is flagging – official statistics put the annual rate at 7%, but most observers believe the real number is closer to 5% (or even lower) – China’s governance problems are becoming impossible to ignore. Although China’s growth rate still exceeds that of all but a few economies today, the scale of the slowdown has been wrenching, with short-run dynamics similar to a swing in the U S or Germany from 2% GDP growth to a 3% contraction.

A China beset by serious economic problems is likely to experience considerable social and political instability. As the slowdown threatens to impede job creation, undermining the prospects of the millions of people moving to China’s cities each year in search of a more prosperous life, the Communist party will struggle to maintain the legitimacy of its political monopoly. (More broadly, the weight of China’s problems, together with Russia’s collapse and Venezuela’s 60% inflation, has strained the belief of some that state capitalism trumps market economies.)

FacebookTwitterPinterest Pedestrians in Hong Kong walk past an electronic board displaying the benchmark Hang Seng index. Photograph: Philippe Lopez/AFP/Getty Images

Given China’s systemic importance to the global economy, instability there could pose major risks far beyond its borders. China is the largest foreign holder of US treasury securities, a major trade partner for the US, Europe, Latin America, and Australia, and a key facilitator of intra-Asian trade, owing partly to the scale of its processing trade.

The world has a lot at stake in China, and China’s authorities have a lot on their plate. The government must cope with the short-term effects of the slowdown while continuing to implement reforms aimed at smoothing the economy’s shift to a new growth model and expanding the role of markets. Foreign firms are seeking access to China’s rapidly growing middle class, which the McKinsey Global Institute estimates exceeds 200 million. But that implies a stable business environment, including more transparency in government approvals, and looser capital controls.

With these goals in mind, China’s government recently engineered a modest currency devaluation – about 3% so far. That is probably too small to alter the country’s trade balance with Europe or the US significantly. But it signals a shift toward a more market-oriented exchange rate. The risk on the minds of investors, managers, and government officials is that currency markets – or government-managed currencies buffeted by market forces – often develop too much momentum and overshoot fundamental values.

As China’s government uses monetary policy to try to calm markets, micro-level reforms must continue. China must deploy new technologies across industries, while improving workers’ education, training and health. Moreover, China needs to accelerate its efforts to increase domestic consumption, which, as a share of GDP, is far below that of other countries.

FacebookTwitterPinterest A bank clerk counts Chinese banknotes in Huaibei, Anhui province. The government recently engineered a modest currency devaluation. Photograph: AP

That means reducing the unprecedentedly high savings rate, a large share of which accrues to state-owned enterprises. If private firms and households are to replace government-led investment as the economy’s main drivers of growth, the state must reduce its stake in major enterprises and allow more profits to be paid directly to shareholders, while providing more of the profits from its remaining shares to citizens.

The shift away from excessive state control should also include replacing price subsidies and grants to favoured industries with targeted support for low-income workers and greater investment in human capital. In addition, China must reduce administrative discretion, introducing sensible, predictable regulation to address natural monopolies and externalities.

Back at the macro level, China needs to reallocate responsibilities and resources among the various levels of government, in order to capitalize on their comparative advantage in providing services and raising revenue. And the country must gradually reduce its total debt load, which currently exceeds 250% of GDP.

Fortunately, in facing the difficult adjustment challenges that lie ahead, China’s $3.6tn (£2.3tn) in foreign-currency reserves can serve as a buffer against unavoidable losses. But China must also avoid reverting to greater state control of the economy, a possibility glimpsed in the authorities’ ham-fisted response to the correction in equity prices. That approach needs to be abandoned before it does any more damage to China’s quest for long-term stability and prosperity.

The Chinese government’s heavy handed efforts to contain recent stock market volatility – the latest move prohibits short-selling and sales by major shareholders– have seriously damaged its credibility. But China’s policy failures should come as no surprise. Policymakers there are far from the first to mismanage financial markets, currencies, and trade. Many European governments, for example, suffered humiliating losses defending currencies that were misaligned in the early 1990s.

Still, China’s economy remains a source of significant uncertainty. Indeed, although the performance of China’s stock market and that of its real economy has not been closely correlated, a major slowdown is under way. That is a serious concern, occupying finance ministries, central banks, trading desks, and importers and exporters worldwide.

China’s government believed it could engineer a soft landing in the transition from torrid double-digit economic growth, fuelled by exports and investments, to steady and balanced growth underpinned by domestic consumption, especially of services. And, in fact, it enacted some sensible policies and reforms.

But rapid growth obscured many problems. For example, officials, seeking to secure promotions by achieving short-term economic targets, misallocated resources; basic industries such as steel and cement built up vast excess capacity; and bad loans accumulated on the balance sheets of banks and local governments.

Nowhere are the problems with this approach more apparent than in the attempt to plan urbanisation, which entailed the construction of large new cities – complete with modern infrastructure and plentiful housing – that have yet to be occupied.

In a sense, these ghost cities resemble the Russian empire’s Potemkin villages, built to create an impressive illusion for the passing Czarina; but China’s ghost cities are real and were presumably meant to do more than flatter the country’s leaders.

Now that economic growth is flagging – official statistics put the annual rate at 7%, but most observers believe the real number is closer to 5% (or even lower) – China’s governance problems are becoming impossible to ignore. Although China’s growth rate still exceeds that of all but a few economies today, the scale of the slowdown has been wrenching, with short-run dynamics similar to a swing in the U S or Germany from 2% GDP growth to a 3% contraction.

A China beset by serious economic problems is likely to experience considerable social and political instability. As the slowdown threatens to impede job creation, undermining the prospects of the millions of people moving to China’s cities each year in search of a more prosperous life, the Communist party will struggle to maintain the legitimacy of its political monopoly. (More broadly, the weight of China’s problems, together with Russia’s collapse and Venezuela’s 60% inflation, has strained the belief of some that state capitalism trumps market economies.)

FacebookTwitterPinterest Pedestrians in Hong Kong walk past an electronic board displaying the benchmark Hang Seng index. Photograph: Philippe Lopez/AFP/Getty Images

Given China’s systemic importance to the global economy, instability there could pose major risks far beyond its borders. China is the largest foreign holder of US treasury securities, a major trade partner for the US, Europe, Latin America, and Australia, and a key facilitator of intra-Asian trade, owing partly to the scale of its processing trade.

The world has a lot at stake in China, and China’s authorities have a lot on their plate. The government must cope with the short-term effects of the slowdown while continuing to implement reforms aimed at smoothing the economy’s shift to a new growth model and expanding the role of markets. Foreign firms are seeking access to China’s rapidly growing middle class, which the McKinsey Global Institute estimates exceeds 200 million. But that implies a stable business environment, including more transparency in government approvals, and looser capital controls.

With these goals in mind, China’s government recently engineered a modest currency devaluation – about 3% so far. That is probably too small to alter the country’s trade balance with Europe or the US significantly. But it signals a shift toward a more market-oriented exchange rate. The risk on the minds of investors, managers, and government officials is that currency markets – or government-managed currencies buffeted by market forces – often develop too much momentum and overshoot fundamental values.

As China’s government uses monetary policy to try to calm markets, micro-level reforms must continue. China must deploy new technologies across industries, while improving workers’ education, training and health. Moreover, China needs to accelerate its efforts to increase domestic consumption, which, as a share of GDP, is far below that of other countries.

FacebookTwitterPinterest A bank clerk counts Chinese banknotes in Huaibei, Anhui province. The government recently engineered a modest currency devaluation. Photograph: AP

That means reducing the unprecedentedly high savings rate, a large share of which accrues to state-owned enterprises. If private firms and households are to replace government-led investment as the economy’s main drivers of growth, the state must reduce its stake in major enterprises and allow more profits to be paid directly to shareholders, while providing more of the profits from its remaining shares to citizens.

The shift away from excessive state control should also include replacing price subsidies and grants to favoured industries with targeted support for low-income workers and greater investment in human capital. In addition, China must reduce administrative discretion, introducing sensible, predictable regulation to address natural monopolies and externalities.

Back at the macro level, China needs to reallocate responsibilities and resources among the various levels of government, in order to capitalize on their comparative advantage in providing services and raising revenue. And the country must gradually reduce its total debt load, which currently exceeds 250% of GDP.

Fortunately, in facing the difficult adjustment challenges that lie ahead, China’s $3.6tn (£2.3tn) in foreign-currency reserves can serve as a buffer against unavoidable losses. But China must also avoid reverting to greater state control of the economy, a possibility glimpsed in the authorities’ ham-fisted response to the correction in equity prices. That approach needs to be abandoned before it does any more damage to China’s quest for long-term stability and prosperity.

Friday 21 November 2014

GDP is a mirror on the markets. It must not rule our lives

By fixating on a snapshot of statistics, we focus on short-termism and lose sight of what the Victorians prized most: value

Next month the Office for National Statistics will issue data for the first time on the UK’s wellbeing. In the exercise, the ONS is recognising that GDP, which now includes estimates for the market value of illegal drugs and prostitution, is at best only a partial measure of our economic health. Not that one would draw this conclusion from the political tub-thumping that improved GDP figures bring.

GDP is a measure of economic activity in the market and in the moment. So its key shortcoming is that it collapses time and makes us short-term in focus. It counts investment and consumption in the same way – an extra £100 spent on education is equivalent to the same amount spent on fizzy drinks.

-----Also read

-----Also read

Economic Growth: the destructive god that can never be appeased

-----

Studies have repeatedly shown that the time horizon of the financial markets in particular is ever more short-term. Shaving about 0.006 seconds off the time it takes computer orders to travel from Chicago to the New Jersey data centre which houses the Nasdaq servers made it worth investing several hundred million dollars in tunnelling through a mountain range to lay the fibre optic cable in a straighter line. More than two-thirds of trades in US equity markets are high-frequency automated orders. How has the search for profit so foreshortened our vision?

It wasn’t always so. The term “Victorian values” now speaks to us of characteristics such as narrow-mindedness, hypocrisy and conformity, but it could also speak of hard work, self-improvement and above all self-sacrifice for the future. The list of the Victorians’ investments in our future is staggering. It includes railways, canals, sewers and roads; town halls and libraries, schools and concert halls, monuments and museums, modern hospitals and the profession of nursing; learned societies, the police, trades unions, mutual insurers and building societies – organisations that have often survived more than a century.

Why the Victorians managed to be so visionary is not entirely clear, but it had something to do with the confidence of an age of discovery both in science and other areas of knowledge, and also in geographical exploration and empire building. They made such strides against ignorance and the unknown, firm in their sense of divine approbation, it seems a belief in progress came naturally to them.

Civic and business leaders in the late 19th century had extraordinary confidence and far-sightedness, even as they too stood at the centre of social and economic upheaval. This Victorian sense of stewardship is something we could usefully remind ourselves of when thinking about how we measure value today. In the late 19th century it was the innovators and the builders of institutions who had standing, and it was the men and women of vision who were understood to be the creators of value.

They still are, even if it is often hard to measure or quantify what they build. Anything of value has its roots in values and vision, as much today as at any time in the past.

Financial markets have their place as a powerful way of harnessing incentives to achieve desirable outcomes. For example, the market in the US for trading permissions to emit sulphur dioxide, which helps cause acid rain, has been a triumphant success in removing what was once a serious environmental harm.

However, there is no sign that the wider public has stopped challenging the ascendancy of markets and money. The bestseller status of Thomas Piketty’s Capital in the 21st Century bears witness to that. It has put the question of the great inequality of wealth in the market economies at the centre of public debate, and it underlines another question: what is the point of economic growth if it does not make most people better off? Or, worse, if growth is actually destroying things that many of us value.

A further problem with GDP is that it obviously includes many things that are value-destroying. Natural disasters are good for GDP growth because of the reconstruction boom afterwards; the destruction of assets and human life is not counted. The metric ignores the depletion of resources, the loss of biodiversity, the impact of congestion, and the loss of social connection in the modern market economy.

People have long proposed alternative measures of progress – recently, environment-adjusted measures, or simply measuring happiness, directly by survey. What could be more straightforward than asking such a direct question? But reported happiness changes very little over time because, whether it’s the joy of a lottery win or the catastrophe of being disabled in an accident, it only takes about two years for people experiencing even a dramatic change in their life to revert to previous levels of happiness.

This takes us back to monetary measures, back to GDP and its inclusion of things that clearly have negative value. It also excludes “informal” activities such as housework and caring, many volunteer activities, and always excludes the full value of innovations. Nathan Mayer Rothschild was the richest man in the world at the time of his death from an infected tooth abscess in 1836. An antibiotic that hadn’t then been invented but now costs just $10 would have saved him. How much would he have paid for that medicine?

Saturday 13 September 2014

Climate crimes: Naomi Klein on greenwashing big business

Soon after reporting on the 2010 BP oil spill, Naomi Klein found she was pregnant – and miscarried. Was there a connection? She looks at the 'greenwashing' of big business and its effects

Naomi Klein: 'My doctor told me that my hormone levels were too low and that I'd probably miscarry, for the third time. My mind raced back to the Gulf.' Photograph: Anya Chibis for the Guardian

I denied climate change for longer than I care to admit. I knew it was happening, sure. But I stayed pretty hazy on the details and only skimmed most news stories. I told myself the science was too complicated and the environmentalists were dealing with it. And I continued to behave as if there was nothing wrong with the shiny card in my wallet attesting to my "elite" frequent-flyer status.

A great many of us engage in this kind of denial. We look for a split second and then we look away. Or maybe we do really look, but then we forget. We engage in this odd form of on-again-off-again ecological amnesia for perfectly rational reasons. We deny because we fear that letting in the full reality of this crisis will change everything.

And we are right. If we continue on our current path of allowing emissions to rise year after year, major cities will drown, ancient cultures will be swallowed by the seas; our children will spend much of their lives fleeing and recovering from vicious storms and extreme droughts. Yet we continue all the same.

What is wrong with us? I think the answer is far more simple than many have led us to believe: we have not done the things needed to cut emissions because those things fundamentally conflict with deregulated capitalism, the reigning ideology for the entire period we have struggled to find a way out of this crisis. We are stuck, because the actions that would give us the best chance of averting catastrophe – and benefit the vast majority – are threatening to an elite minority with a stranglehold over our economy, political process and media.

That problem might not have been insurmountable had it presented itself at another point in our history. But it is our collective misfortune that governments and scientists began talking seriously about radical cuts to greenhouse gas emissions in 1988 – the exact year that marked the dawning of "globalisation". The numbers are striking: in the 1990s, as the market integration project ramped up, global emissions were going up an average of 1% a year; by the 2000s, with "emerging markets" such as China fully integrated into the world economy, emissions growth had sped up disastrously, reaching 3.4% a year.

That rapid growth rate has continued, interrupted only briefly, in 2009, by the world financial crisis. What the climate needs now is a contraction in humanity's use of resources; what our economic model demands is unfettered expansion. Only one of these sets of rules can be changed, and it's not the laws of nature.

What gets me most are not the scary studies about melting glaciers, the ones I used to avoid. It's the books I read to my two-year-old. Looking For A Moose is one of his favourites. It's about a bunch of kids who really want to see a moose. They search high and low – through a forest, a swamp, in brambly bushes and up a mountain. (The joke is that there are moose hiding on each page.) In the end, the animals all come out and the ecstatic kids proclaim: "We've never ever seen so many moose!" On about the 75th reading, it suddenly hit me: he might never see a moose.

I went to my computer and began to write about my time in northern Alberta, Canadian tar sands country, where members of the Beaver Lake Cree Nation told me how the moose had changed. A woman killed one on a hunting trip, only to find the flesh had turned green. I heard a lot about strange tumours, which locals assumed had to do with the animals drinking water contaminated by tar sand toxins. But mostly I heard about how the moose were simply gone.

And not just in Alberta. Rapid Climate Changes Turn North Woods into Moose Graveyard read a May 2012 headline in Scientific American. A year and a half later, the New York Times reported that one of Minnesota's two moose populations had declined from 4,000 in the 1990s to just 100. Will my son ever see a moose?

In our desire to deal with climate change without questioning the logic of growth, we've been eager to look both to technology and the market for saviours. And the world's celebrity billionaires have been happy to play their part.

In his autobiography/new age business manifesto Screw It, Let's Do It, Richard Branson shared the inside story of his road to Damascus conversion to the fight against climate change. It was 2006 and Al Gore, on tour with An Inconvenient Truth, came to the billionaire's home to impress upon him the dangers of global warming."It was quite an experience," Branson writes. "As I listened to Gore, I saw that we were looking at Armageddon."

As he tells it, his first move was to summon Will Whitehorn, then Virgin Group's corporate and brand development director. "We took the decision to change the way Virgin operates on a corporate and global level. We called this new approach Gaia Capitalism in honour of James Lovelock and his revolutionary scientific view" (this is that the Earth is "one single enormous living organism"). Not only would Gaia Capitalism "help Virgin to make a real difference in the next decade and not be ashamed to make money at the same time", but Branson believed it could become "a new way of doing business on a global level".

'For two years after I covered the 2010 BP spill in the Gulf of Mexico, I couldn't look at any body of water without imagining it covered in oil.' Illustration: Noma Bar for the Guardian

Before the year was out, he was ready to make his grand entrance on to the green scene (and he knows how to make an entrance – by parachute, by jetski, by kitesail with a naked model clinging to his back). At the 2006 Clinton Global Initiative annual meeting in New York, the highest power event on the philanthropic calendar, Branson pledged to spend $3bn over the next decade to develop biofuels as an alternative to oil and gas, and on other technologies to battle climate change. The sum alone was staggering, but the most elegant part was where the money would be coming from: Branson would divert the funds generated by Virgin's fossil fuel-burning transportation lines.

In short, he was volunteering to do precisely what our governments have been unwilling to legislate: channel the profits earned from warming the planet into the costly transition away from these dangerous energy sources. Bill Clinton was dazzled, calling the pledge "ground-breaking". But Branson wasn't finished: a year later, he was back with the Virgin Earth Challenge – a $25m prize for the first inventor to figure out how to sequester 1bn tonnes of carbon a year from the air "without countervailing harmful effects". And the best part, he said, is that if these competing geniuses crack the carbon code, the "'doom and gloom' scenario vanishes. We can carry on living our lives in a pretty normal way – we can drive our cars, fly our planes." The idea that we can solve the climate crisis without having to change our lifestyles – certainly not by taking fewer Virgin flights – seemed the underlying assumption of all Branson's initiatives. In 2009, he launched the Carbon War Room, an industry group looking for ways that different sectors could lower their emissions voluntarily, and save money in the process. For many mainstream greens, Branson seemed a dream come true: a media darling out to show the world that fossil fuel-intensive companies can lead the way to a green future, using profit as the most potent tool.

Bill Gates and former mayor of New York Michael Bloomberg have also used their philanthropy aggressively to shape climate solutions, the latter with large donations to green groups such as the Environmental Defense Fund, and with the supposedly enlightened climate policies he introduced as mayor. But while talking a good game about carbon bubbles and stranded assets, Bloomberg has made no discernible attempt to manage his own vast wealth in a manner that reflects these concerns. In fact, he helped set up Willett Advisors, a firm specialising in oil and gas assets, for both his personal and philanthropic holdings. Those gas assets may well have risen in value as a result of his environmental giving – what with, for example, EDF championing natural gas as a replacement for coal. Perhaps there is no connection between his philanthropic priorities and his decision to entrust his fortune to the oil and gas sector. But these investment choices raise uncomfortable questions about his status as a climate hero, as well as his 2014 appointment as a UN special envoy for cities and climate change (questions Bloomberg has not answered, despite my repeated requests).

Gates has a similar firewall between mouth and money. Though he professes great concern about climate change, the Gates Foundation had at least $1.2bn invested in oil giants BP and ExxonMobil as of December 2013, and those are only the start of his fossil fuel holdings. When he had his climate change epiphany, he, too, raced to the prospect of a silver-bullet techno-fix, without pausing to consider viable – if economically challenging – responses in the here and now. In Ted talks, op-eds, interviews and in hisannual letters, Gates repeats his call for governments massively to increase spending on research and development, with the goal of uncovering "energy miracles".

By miracles, he means nuclear reactors that have yet to be invented (he is a major investor and chairman of nuclear startup TerraPower), machines to suck carbon out of the atmosphere (he is a primary investor in at least one such prototype) and direct climate manipulation (Gates has spent millions funding research into schemes to block the sun, and his name is on several hurricane-suppression patents). At the same time, he has been dismissive of the potential of existing renewable technologies, writing off energy solutions such as rooftop solar as "cute" and "noneconomic" (these cute technologies already provide 25% of Germany's electricity).

In 2006, after meeting Al Gore, Richard Branson pledged £3bn to battle climate change over the following decade. He has since spent just £230m. Photograph: Bruno Vincent/Getty Images

Almost a decade after Branson's epiphany, it seems a good time to check in on the "win-win" crusade. Let's start with his "firm commitment" to spending $3bn over a decade developing a miracle fuel. The first tranche of money he diverted from his transport divisions launched Virgin Fuels (since replaced by private equity firm Virgin Green Fund). He began by investing in various agrofuel businesses, including making a bet of $130m on corn ethanol. Virgin has attached its name to several biofuel pilot projects – one to derive jet fuel from eucalyptus trees, another from fermented gas waste – though it has not gone in as an investor. But Branson admits the miracle fuel "hasn't been invented yet" and the fund has since moved its focus to a grab-bag of green-tinged products.

Diversifying his holdings to get a piece of the green market would hardly seem to merit the fanfare inspired by Branson's original announcement, especially as the investments have been so unremarkable. If he is to fulfil his $3bn pledge by 2016, by this point at least $2bn should have been spent. He's not even close. According to Virgin Green Fund partner Evan Lovell, Virgin has contributed only around $100m to the pot, on top of the original ethanol investment, which brings the total Branson investment to around $230m. (Lovell confirmed that "we are the primary vehicle" for Branson's promise.)

Branson refused to answer my direct questions about how much he had spent, writing that "it's very hard to quantify the total amount… across the Group". His original "pledge" he now refers to as a "gesture". In 2009, he told Wired magazine, "in a sense, whether it's $2bn, $3bn or $4bn is not particularly relevant". When the deadline rolls around, he told me, "I suspect it will be less than $1bn right now" and blamed the shortfall on everything from high oil prices to the global financial crisis: "The world was quite different back in 2006… In the last eight years, our airlines have lost hundreds of millions of dollars."

Given these explanations for falling short, it is worth looking at some of the things for which Branson did manage to find money. In 2007, a year after seeing the climate light, he launched domestic airline Virgin America. From 40 flights a day to five destinations in its first year, it reached 177 flights a day to 23 destinations in 2013. At the same time, passengers on Virgin's Australian airlines increased from 15 million in 2007 to 19 million in 2012. In 2009, Branson launched a new long-haul airline, Virgin Australia; in April 2013 came Little Red, a British domestic airline.

So this is what he has done since his climate change pledge: gone on a procurement spree that has seen his airlines' greenhouse gas emissions soar by around 40%. And it's not just planes: Branson has unveiled Virgin Racing to compete in Formula One, (he claimed he had entered the sport only because he saw opportunities to make it greener, but quickly lost interest) and invested heavily in Virgin Galactic, his dream of launching commercial flights into space, for $250,000 per passenger. According to Fortune, by early 2013 Branson had spent "more than $200m" on this vanity project.

It can be argued – and some do – that Branson's planet-saviour persona is an elaborate attempt to avoid the kind of tough regulatory action that was on the horizon when he had his green conversion. In 2006, public concern about climate change was rising dramatically, particularly in the UK, where young activists used daring direct action to oppose new airports, as well as the proposed new runway at Heathrow. At the same time, the UK government was considering a broad bill that would hit the airline sector; Gordon Brown, then chancellor, had tried to discourage flying with a marginal rise in air passenger duty. These measures posed a significant threat to Branson's profit margins.